I completed my first No Spend Challenge a few months ago. This challenge changed the way that I view spending money. I'm going to break the whole concept down for you and help you establish some ground rules to create a challenge for yourself.

After an expensive holiday season, I wanted to get a better handle on my finances. I felt like there was so much excess. Too many celebrations, too much food, too many purchases, and just too much stuff. I needed a reset. That's when Facebook fed me a group suggestion for a "No Spend Challenge." I was intrigued. I hit the join button and started researching.

What is a No Spend Challenge?

Just like the name suggests, a no spend challenge is a spending freeze for all nonessentials for a set period. Most people choose 30 days, but some choose an entire year.

What exactly is "nonessential" is up to you. That's the beauty of this challenge. You set the rules and expectations. Basically, you should only spend money on household bills and necessities like gas and groceries.

What is a 30 Day No Spend Challenge?

A 30 Day No Spend Challenge is exactly like it sounds. No unnecessary spending for 30 days. To see exactly what that looks like, just keep reading.

How do you do No Spend for a Year?

I'd buckle up for that ride! Doing No Spend for a year (yes, I used No Spend as a verb) will take real determination. It's entirely doable, especially if you've got a specific goal in mind to keep you motivated.

How Do You Do a No Spend Challenge?

First, decide why you WANT to do a No Spend Challenge. What's your motivation? What's your goal? Do you want to curb your emotional spending? Do you want to pay down your debt? Is your goal to save $1000? Maybe you want to do all of these things. Write down your goals. Make them as clear as possible.

Second, it's a good idea to assess your spending. How much do you spend per month? Where is your money going? My favorite way to do this is to use a budget worksheet. I put together a complete No Spend Challenge Bundle of worksheets and tools that are available on Etsy. List out all of your essentials first.

What is Considered Essential spending?

- Rent or mortgage payments

- Utility bills (water, electric, sewer, garbage)

- Fuel: oil or propane for home

- Insurance (homeowner's, car, health, dental)

- Cable or streaming services

- Internet

- Pest control

- Lawn maintenance

- Alarm monitoring

- Cell phone

- Car payment

- Gas

- Groceries

- Medication

- Cleaning supplies

- Toiletries

- Child care

- Planned gifts

- Tithes or planned giving

- Gym membership

- Credit card payments (from previous purchases)

Once you list out all of these items, write down how much you spend on each one and total it up. That will give you your essential budget. Hopefully, that amount is less than your monthly income.

Now, it's time to figure out your nonessential spending. This is going to be different for everyone. This is meant to be a gut check. It's time to decipher what you NEED versus what you WANT. The list below is certainly not all-inclusive; it's just meant to get you thinking about your specific spending habits

What is Considered Nonessential spending?

- Eating out or takeaway / to-go food

- Coffee (Starbucks, Dunkin, etc)

- Clothing, shoes, and accessories

- Makeup

- Home decor items

- Subscription services (think Audible, Netflix, Hulu, Amazon Prime, Disney+)

- Cable (this is on both lists, but it's something to consider cutting)

- Gym memberships (if you do not currently use your membership routinely)

- Manicures/pedicures

- Unplanned events (may include movies, bowling, entertainment centers, concerts, etc)

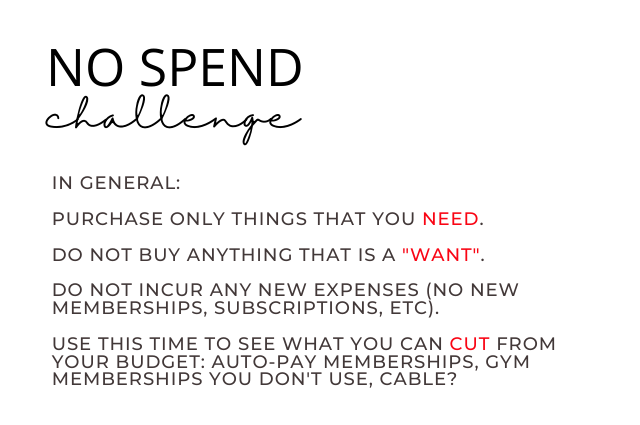

Rules for a No Spend Challenge

It's time to set your rules. What are you allowing yourself to spend money on and what is off-limits? Create your rules and write them down. You could use a notebook or journal, or purchase a printable No Spend Challenge bundle. I see the irony here, but sometimes it's worth spending money on the tools that set you up for success.

For me, I needed to curb my clothing, shoes, and accessories purchases. I tend to make online purchases when I'm bored but I have more than I need. I also wanted to stop eating out and getting takeout. I'm perfectly capable of making meals at home. I did need to make one clothing purchase for work so I added that to my exceptions lists. Planned purchases are okay. Emotional spending or getting takeout, because I'm feeling lazy, is not okay.

Things to consider when doing No Spend

You'll see that some items are on both the essential and nonessential spending lists. This is because these items are very specific to each person. Maybe you have a gym membership that you haven't used in months. Cancel it! My gym membership is used almost daily so that is a non-negotiable for me. However, I hadn't watched cable TV in years so I canceled it and saved myself $160/month.

Another gray area is grooming. If you're doing a No Spend Challenge for several months or a year, it's not reasonable for you to go without a haircut or color for that long. But, maybe you could do your color at home? Instead of manicures and pedicures at a salon, try to do them yourself at home.

I tend to stockpile certain items when they're at their rock-bottom prices (thank you, years of couponing and bargain shopping). Because of this, I have a backstock of cleaning supplies and toiletries. I didn't need to buy any personal hygiene items or cleaning supplies during my challenge but if you need to, just buy what you need. The only exception I made during my No Spend month was that if I found something I use often that was heavily discounted or on clearance, then I'd buy it.

Hide and Snooze

If you're addicted to Amazon shopping, consider deleting the app from your phone during the challenge. Do this for any website or app that might be tempting. You see, this will be a very personal journey.

I spend a lot of time on social media. My job demands it, so I'm constantly scrolling Facebook, Instagram, and Pinterest. With this comes a LOT of ads. And, these advertisers are smart. They know exactly what I'm in the market for and serve me plenty of ads until I convince myself that I actually need that item. So, I hid ads all month. I hit that "x" and hid ad after ad for the entire 30 days. I also snoozed every buy/sell/trade group that I was in. This proved to be a very successful strategy for me.

Cutting Expenses

I also decided to use this time to cut anything unnecessary from my budget. I went through every purchase and transaction from the months before my challenge to see where my money was going. You might be surprised by services or memberships that you're being charged for but aren't using.

For example, I realized I had recurring monthly charges from Audible and Scribd. I have a library card, so with it, I created a Hoopla account and canceled both Audible and Scribd. That saved me a total of $214 per year. I saved $1920 per year by cutting cable. By switching my Verizon plan (which cost me $1 more per month), they included Disney+, Hulu, and ESPN. We also decided to keep Netflix. We are not lacking in things to watch.

Go through your charges and see what you can cut. Think subscription boxes, auto-ship from Amazon, memberships, and anything else that might be on subscribe and save.

This is also a good time to go through and see if you're eligible for any discounts with any of your providers. I was able to save $10/month by signing up for auto-pay with my checking account. Since I'd be paying that bill anyway, it makes sense for me to save $120/year. It all adds up.

Find support during your challenge.

In a perfect world, you would do this challenge with your spouse or partner. Or, your best friend. Accountability and support can go a long way. But, if you're flying solo, there are resources you can tap into.

There are some great No Spend Challenge or No Spend groups on Facebook. These groups are full of other people who are going through exactly what you are. Their goals may be different, but everyone has the same mindset. You'll pick up great tips and have renewed motivation.

Another great resource could be a local "Buy Nothing" group. These groups were created for people to pass on what they aren't using. You can also post if you're searching for something specific. Maybe someone in the group has exactly what you need and they'd be willing to gift it to you.

How to track your No Spend Challenge

It's a good idea to keep track of your No Spend Challenge. This will keep you accountable and motivated. I used a one-page calendar to track my spending. I wrote the dollar amount that I spent each day but color-coded the text. Green ink was used for a No Spend day. Yellow ink was for money spent on essentials. Red was for non-essential spending. It was helpful for me to visually see my progress.

If (or when) you make a mistake, it's helpful to write why you think it happened. Maybe you were stressed at work and felt like you needed a coffee. Write it down. When you're reflecting on it, maybe you can come up with alternative coping strategies for the next time.

I've mentioned it a few times, but after completing this challenge, I created a No Spend Challenge PDF bundle of worksheets to help guide you. You could always use a daily planner or journal. Whatever works for you!

At the end of the month, take time to reflect on what you spent during the month versus what you would have spent in an average month. It can be significant!

If you decide to take the plunge, I'd love to hear your results.

Miranda says

I’ve heard about no spend challenges

But never actually tried one yet!