Do you have money set aside in case of an illness, accident or disaster? I've partnered with Allstate to talk about why you need an emergency fund and how to start one. Plus, I've got a free printable savings tracker so you get and stay motivated to build your emergency fund.

It's important for every family to have an emergency fund. Even singles or married couples with no kids can benefit from having a stockpile of money to use in unexpected situations. You never know when you or your child may get sick or some other emergency expense will arise. What happens if a driver cuts you off and you swerve into a curb and both of your tires pop? Your insurance deductible might be over $500. Or, what if your hot water heater explodes and damages your home? Now you need a new hot water heater and new flooring. Do you have that kind of money laying around?

If you are living on a budget, having an emergency backup fund is extremely important. Let’s take a look at the why’s of building an emergency fund before getting into the how’s.

4 Benefits of Building an Emergency Fund

1. Keeps you from having more debt – If you have a sudden car repair or medical bill, your emergency fund will protect your bank account. With the money you have saved, you can pay the bill without whipping out your credit card, thus creating more debt for your family.

2. Lowers your monthly expenses – With an emergency fund, you can pay a medical bill or other large statement without having to set up a payment plan. This keeps your month-to-month costs low, since no added expenses (and added interest) are tacked onto the budget.

3. Gives you financial peace – There isn’t as much worry about money if you have an emergency fund built up. When you need to replace a tire on your vehicle, you can simply pull $150 out of your emergency account rather than stress about where the money is going to come from. It’s like having a buffer against the unexpected!

4. Protects your family – Not only will you be keeping your bank account safe from unexpected situations, you can also protect your family with an emergency fund. With this stash of cash, you can get your child the medications he needs for a sinus infection without batting an eye. You could also replace your daughter’s car seat once she outgrows her old one. Little things like this keep everyone protected from day-to-day dangers.

How to Start an Emergency Fund

In order to build a sufficient emergency fund for your family, you should decide exactly how much money you need to put back. The amount recommended by most experts is $1,000. However, in line with Dave Ramsey's teachings, I would suggest you add up your living expenses, and make sure you have 3-6 times worth that amount in the fund.

There are several ways you can build your emergency fund – and do it quickly. It shouldn’t take you more than one year to stock your fund with the money necessary to protect your family from unforeseen circumstances.

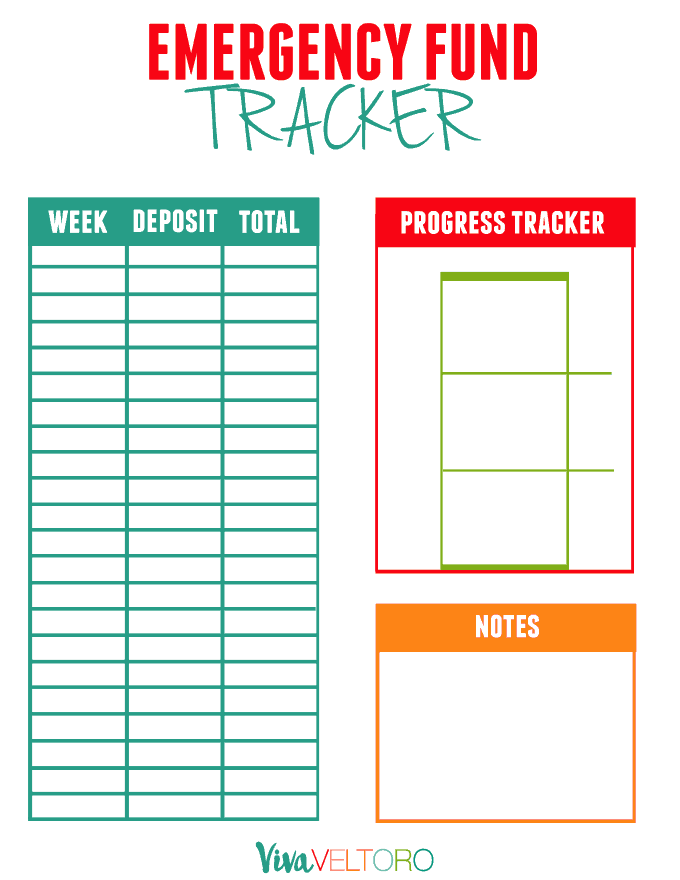

Printable Savings Tracker

Click HERE to print the full size PDF Printable Savings Tracker

This printable savings tracker will help you stay motivated and organized when building your emergency fund. Record every deposit you make into the fund, and keep a running balance. The visual progress tracker can be shaded in as you build your emergency fund, to help you continue your progress! Note the ⅓ and ⅔ amounts on the lines beside the bar, then shade it in with each deposit.

5 Ways to Build your Emergency Fund Fast

Here are a few ways you can put money into the fund so it gets fully stocked quickly:

1.) Get a part-time job: Just a few hours a week can be enough to put more into your emergency fund each week. You could also harness your talents with these crafts to make and sell.

2.) Sell unused belongings: Clean out closets, the attic, and the basement. Hold a garage sale or list your items you no longer need on swap sites or selling sites. Put the profits into your emergency fund.

3.) Cut back on expenses: Eliminate some of the unnecessary costs in your monthly budget, including eating out, Starbucks coffees, and purchasing lottery tickets. Instead, put these amounts toward the fund.

4.) Use a zero-balance budget: Rather than leaving a few hundred dollars in your bank account at the end of each month, move it into your emergency fund. Leave yourself with a zero balance that will start over at the beginning of each new month.

5.) Save your change: Anytime you use cash for a purchase, put the coins you receive in a jar. Deposit the money into your emergency fund once the jar is full. Also, check with your bank to see if they have a "keep the change" program where they round up your debit purchases to the nearest dollar and transfer that change into a savings account.

Additional Tips about your Emergency Fund

To be successful with your emergency fund, you must understand what constitutes a true emergency. You don’t want to waste your fund on purchases that aren’t extremely necessary.

Your emergency fund is not for: concert tickets that just went on sale, birthday or holiday gifts, costs that aren’t surprises, like a vehicle tag renewal. The emergency fund is also not for any “just because” purchase.

However, your emergency fund can cover unexpected expenses such as: car repair, job loss, medical bills, home damage, emergency pet care, or sudden dental work.

Where to keep your emergency fund.

Some people may wonder where to keep their emergency fund, in order to have access to it without spending it. That is really a decision for you and your family. Some keep cash in a fireproof safe, so they can get to it as needed. Others open a savings account with their bank dedicated to the emergency fund. That way, the money is a little more difficult to access, and gives you time to stop and think about using the money before you just spend it.

I hope you put our printable savings tracker to good use to start building your emergency fund!

This post was written as part of the Allstate Influencer Program and sponsored by Allstate. All opinions are mine. As the nation’s largest publicly held personal lines insurer, Allstate is dedicated not only to protecting what matters most–but to guiding people to live the Good Life, every day.

Sapana V says

This is an awesome idea to track the savings. Saving is necessary these days

Amber Ludwig says

SUCH a great idea!! I love that on the printout it trackers your progress!! I love being able to see how close I am to my goal.

Angie Archerda says

This is a great idea. I save all year long for birthdays and holidays as well

Deborah D says

I have an emergency fund in place. This pot is great to remind people of how important an emergency fund.

Ashley Chassereau Parks says

We need to build our emergency fund back up... we've been hit with a lot lately. Here's praying the next few months are easy on us. lol

Edye says

What a great thing to have! Thanks for sharing.

Linda Manns Linneman says

I have found over my many years that having an emergency fund is so important to have. You never know when something unexpected is going to come up. Thank you so much for sharing this

Jo-Ann Brightman says

No one wants to get caught unprepared and the printable should help one to get started.

Cami says

I love these tips, great reminders! Budget in is a struggle for me but I would love having a more secure emergency fund.

mary walters says

very good idea. every family should do this

gloria patterson says

This is a lot of great information that everybody you read and do. College students should be reading and doing something like this. I know they don't have a lot of time and or money to do but they should be aware

DENISE LOW says

Thank you for sharing. This is a great idea. Everyone should have one.

Cathy Jarolin says

I used a planner something like this when my Girls were children. It is amazing how quickly the money adds up! Your right you never know when something comes up and you need the extra money! Thank You for sharing this Important Post..

gloria patterson says

I am going to pass this along to my niece. She works hard and has a part time job but never catches up. She borrows from family BUT she always PAYS it back. She would love to get a head

Pat F says

always need an emergency fund. I always carry $20 cash in my wallet for that reason. Love your suggestions and ideas!

Kristina Crafton says

I plan to print this soon! Also going to be taking Dave Ramsey classes soon, this is reassurance that it's a good idea ! Thank you so much.

Jenn k says

Great idea! Thanks.

Vickie Whitley says

Everyone needs an emergency fund put up. You never know what will happen.

Mary Simonton says

Great idea for everyone. Love all your posts. Lots of helpful information

Miranda Welle says

The tracker is a good idea. We do have an emergency fund but are hoping to build it up a little bit more.

Erin Chadwick says

Wow! Great idea

Elizabeth says

I have never thought about using a tracker before. I think I will print these out and save myself from a headache on how much money I spend and what I spend it on.

Thanks.

Yexenia says

This is so helpful!

Lynn Slape says

Great idea and the reasons are really relevant to any family today. We already have an emergency fund but the tracker is a great addition to what we're already doing! Thank you for the information!

Anita Kell says

Thank you for the free printable! It's always smart to have a nest egg

Crystal Sard says

Saving money is so hard.. This looks like it could be really helpful for us!

Helene H says

Great idea-i have been extra worried, as you never know when emergencies will arise-my husband lost 2 jobs in two years due to the ecomomy...

Angel says

Emergency funds are crucial! We used every bit of our 10,000 dollar fund while my husband was out of work for over a year. Takes away a lot of stress.

Nicole Becker says

Great idea thank you!!

Misty A. says

Great ideas on ways to save. I personally like saving my loose change. It really does add up.

Deeanna Campbell says

This such great idea.I actual use something similar on another website off google crome

Jennifer babich says

What an important lesson!! And the printable trackers make it seem doable

Meghan K Duvall says

Great tips. Thanks for the tools.

Helen says

This is definitely a must have. Thank you so much for the free printables too. They will surely be put to good use.

tonni says

awesome idea. thanks for the share

Jordan R says

What a great idea!

Jessica Kruger says

I am definitely bookmarking this page! I want to start budgeting more.

Allison Andreoli says

This is something I need to start doing!!

Laurie Snow says

I need to do this! Not enough emergecy funds saved ever!

ronnie mewbourn says

so true everyone needs to see this

Mnady Omasta says

Awesome! We all need to be financially prepared!

Valerie Lerma says

great idea to track my spending and savings i might have

Elizabeth Johnson says

We havent taken dave ramseys course yet. My family has as far as parents and sibling. We have kept a good savings account. (not a huge load but good enough) I have always been pretty frugal but i think i can still benefit more from this. Thank you.

Mia says

Good reminder for us all to have budgets and they about finances in advance.

Vanessa Dalton says

good idea. Very helpful

Victoria Scott says

Thank you for this! I love printable hacks! Makes things so much easier!

Linda Manns Linneman says

I have learned throughout the years that this is so important. You never know when something will happen. Thank you so much for sharing this

Racheal Kearbey-witherell says

I'm working towards my emergency fund of $100

Jewls says

This looks like a very good idea.

Edye says

This is so true! Such a great reminder, thank so much :]

denise low says

I think everyone needs a emergency fund. You never know when something goes wrong.

Jonathan B says

pretty cool idea, might be worth trying it out for myself here sooner than later.

Julie M. says

The printout is so helpful! So much easier to track your progress when you see your goal!

Kari Judd says

Great Ideas!! Thank You!

Lauren Jones says

I could definitely use this.

Chastity says

This is a great idea. When I was single I had emergency money but don't know what happen when I got married. Definitely need to start this again. One never knows.

Meghan k says

We could definitely benefit from this. Thanks!

Cathy Jarolin says

This is my Kind of Savings Tracker! I find charting and writing it down keeps me on top of the money I am saving! This way keeps things so much more manageable & Organized...

Sandra Watts says

My fund just got raided the other day . I just throw my change in a big big jug!

Kimberly Harbour says

This is a great idea! Thanks I will definitely start doing this for my family!

denise low says

Thank you for sharing. Everyone needs an emergency fund.

Heather Cahill says

Very good idea!

Mia says

Having the peace of mind from knowing that there was a fund would be very comforting.

Rija says

This is a good idea !

Jessica Lodge says

Great tips!! I'm working on selling unused items. It so important to have an emergency fund!!

Mariah says

This is a good idea. My kids and I save any change we can. Even when we find a penny we add it to our piggy bank. As,for some of the other things we have a more difficult time being able to do so. Any extra we get has,to go for the month in our home as our income is very low for 5 people.

Lisa Bohn says

Everyone could use this

Vanessa Dalton says

Thank you for the wonderful info

Ashley Chassereau Parks says

I need to get our emergency fund built back up. We bought our house in August and have been renovating as much as possible, but now we need to build up our savings for a bit. I wish I could add in a part time job.... still trying to figure that out being a SAHM and homeschooling. AH!

katie says

These are great tips! I save my change in a bag and whenever I'm in a store that does self check out I empty out that bag of change. Sometimes it's enough for $10 off the amount. I'm selling all my unused items on an app as well. Looking for all those ways to save!

Kayla Norris says

My family definitely saves. I am going to send this to a few friends to help them get the start they need.

Sarah Piecznski says

Very useful tool! Thank you for sharing!

Angela hamel says

I will be doing this, thank you ever so much for sharing!!

CHRISTY SWEENEY says

So very important. You never know what life will throw at you. Very important to prepare instead of having to count on others to pick up the pieces if a tragedy happens

Richard Hicks says

This is something EVERYONE needs to have. Good tips to get one started.

Lauryn R says

This is such a great idea! I have always been a fan of note taking and list making! 🙂 It helps so much to stay organized, especially when it comes to finances. Thank you so much for sharing your print out!

Karen Propes says

I agree with you. I've always had an emergency fund we add to each month I don't have a tracker, we track ours with our billing tracker. I enter every time we make a deposit and how much. I just keep up with all that on the bill tracker because it's all right there when we pay the bills. This is a great idea.

Loni H says

Love the saving tracker. We are definitely a savings family!

Kathy Pease says

Such great advice..You should always be prepared for the unexpected

Heather w says

This is so true! We have been trying to build our emeegency fund this past year.

YVONNE WOODSTOCK says

My-husband-is-awesome-at-putting-money-aside-in-case-of-some-kind-of-unexpected-emergency-and-it-has-

been-gravely-needed-beyond-our-ideas-we-even-considered-when-saving-it.

Thanks-for-sharing-this-info-and-resource/tools...I-think-some-of-our-young-adult-kids-would-really

appreciate-this.

Sue E says

I really liked some of the points you made regarding emergency money! A couple of mistakes that I have made - like using our emergency fund for Birthday or Christmas gifts. Plus we have thrown our change into a jar. We have, on occasion, used our change jar money for emergencies & was shocked to find out that there was only a little over $500 in it!

So everything does add up. Thanks for the budget sheets! I will use them.